Invigorated by the Dallas charm, investors, businesses and others flock to this southern metropolitan by the thousands. Dallas has gained traction over the years, as evident by rising population rates. Dallas had a population of 1,317,929 as of June 2016 which is a 10% growth from 1,197,816 in 2010. While, the Dallas Fort Worth area as a whole has a population of just under 7 million. Located within the heart of the Silicon Prairie, Dallas, Texas has become a prime city for both new businesses and huge Fortune 500 companies. Dallas Fort Worth is the country’s fourth largest metropolitan area with a high growth rate expected in the near future.

Dallas’ relatively recent rise to stardom comes as no surprise given the city’s affordability, job market, and diverse economy. The Dallas Fort Worth area is a prime player in the commercial real estate industry, with a promising flexible office future.

Corporate real estate managers and C-suite executives are beginning to organize their real estate portfolios into core and flexible offices. Core – stable office space that companies rent out for terms spanning years, mostly as headquarter spaces in established markets. Flexible – offices rented for spans of hours, months, and years for the purpose of satellite space, expansion space, and to provide employees with mobility options. Flexible offices are often furnished or serviced workspaces. They come from coworking providers, serviced office centers and direct from landlords.

Brokerage firm CBRE predicts that 65% of US companies will use coworking as part of their office portfolio by 2020. The LiquidSpace Q4 2016 Flexible Office Report specifies that technology, finance, and communications companies most commonly use flexible office space. In fact, the Dallas economy centers around technology and communications. Additionally, Dallas’ changing workforce and economy make flexible office space the best option for many companies.

Flexible office space is a lot more affordable than renting traditional core offices. Renters can expect to pay $26.64 per square foot for office space in Dallas. The average yearly cost for core (traditional) office space, considering 150 square feet per worker, is $3,996 per year per person. Whereas, the average price per person for flexible office space is $176 for flexible office space, totaling to an affordable $2,116 per year.

LiquidSpace is adding to the available flexible office market through a product called altSpace. altSpace combines carefully curated office fit-outs with LiquidSpace-approved landlord and partner spaces. In addition to space and fit-out, the altSpace service layer provides design consultation, IT procurement, and a dedicated LiquidSpace concierge. The LiquidSpace concierge is there to help manage a customer’s move and the facility manager’s needs.

Dallas has quickly adopted the altSpace model, as the tech and communication industries boom in the city. To get insights into how a Fortune 500 company put their team culture first in a Dallas altSpace, read their Customer Story. Building operators are adding flexibility to their asset portfolio to meet the evolving needs for flexibility from customers. Prominent commercial real estate company Olymbec has added altSpace to their portfolio in the Dallas Central Business District. Learn how you can leverage the altSpace program as a building owner.

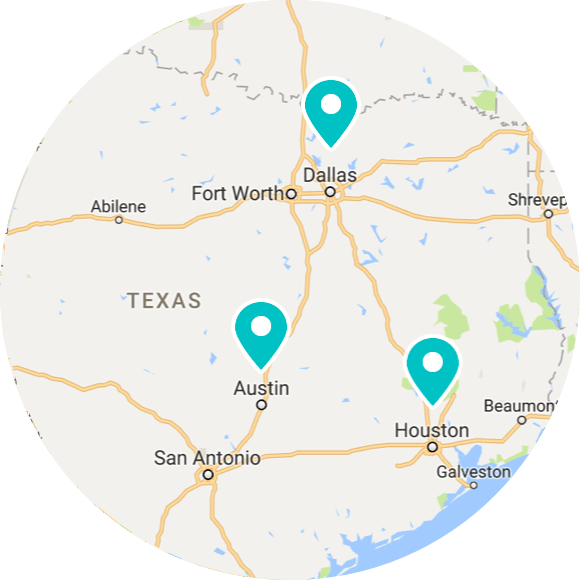

Employment growth in Dallas has also been soaring, given the rising availability of quality jobs. Dallas is responsible for 8 percent of the U.S job growth rate since January 2008. There has been a recent emergence of large corporations placing their headquarters around Dallas. More jobs created in Texas come from the DFW than San Antonio, Austin, or any other metropolitan area. The unemployment rate, as of June 2017, is 4% compared to the United States at large, at 4.5%. In addition to affordable living in Dallas, the average weekly wage rate continues to rise, reaching $1,100 as of this past year. Workers are represented in a wide range of fields, including but not limited to information, trade, utilities, transportation and manufacturing.

Paramount Property Analysis stipulates that most new office space development will still be concentrated in Uptown and Far North Dallas. Dallas’ rising employment and population trends make flexible office space a stronger option than traditional office space. A significant rise in millennials within the workforce will further impact the specifics of flexible office space demand.

Millennials, aged 16-35, comprise 32% of the Dallas population with an expected growth rate of 12.2% in 5 years. The rise in millennials can be attributed to Dallas’ high post-grad university student retention rate. Our previous research shows that millennials prefer more comfortable and collaborative workspaces.

A focus on flexible office space will also solve many of the problems that come along with Dallas’ rising population rates and popularity.

Flexible office space will address Dallas’ rising commuting times for employees.

Currently, commuters in Dallas are fortunate enough to spend only 26 minutes traveling to work on average.

However, rising population rates will most likely increase traffic during peak commuting times.

Also, the demands for new office construction are high enough to drive a construction labor shortage.

Dallas boasts vast open and available land space for real estate development.

Yet this could change given expert predictions of an occupancy max out by 2018.

More flexible workspace options will contribute to more efficient land usage.

Ultimately, flexible office space is still the optimal means to accommodate Dallas’ new influx of companies in an affordable and efficient manner.