Ranked as the best place to live, by US News, Austin brings in 50 new residents a day. From its vibrant music scene, to an influx of tech jobs, and abundant access to outdoor space people are flocking to Austin. Austin had a population of 947,890 as of July 2016 which is a 16% growth from 811,045 in 2010, larger growth than that of Dallas. This rapid population growth has increased the need for more flexible office space. The number of bookable flexible office locations on LiquidSpace have increased 2.5X over the last year alone. Today there are over 578 readily available spaces to book.

Corporate real estate managers and the C-suite are beginning to organize their real estate portfolios into core and flexible offices. Core – stable office space that companies rent out for terms spanning years mostly for headquarter spaces or established markets. Flexible – offices rented for spans of hours, months, and years. Companies use flexible office for: satellite space, expansion space, and to provide employees with mobility options. Flexible offices are often furnished, serviced workspaces from coworking centers, serviced office providers, and landlords & buildings.

Flexible office space is a lot more affordable than traditional core office space. Renters can expect to pay $37.34 per square foot for office space in Austin. If you have 150 square feet of space per employee, the cost for a core space is about $5,601 per employee per year. Whereas, the average price per person for flexible office space is $475, adding up to an affordable $5,697 per year.

An area where LiquidSpace is adding to the available flexible office options is through altSpace. altSpace combines carefully curated office fit-outs with LiquidSpace approved landlord and partner spaces. In addition to space and fit-out the altSpace service layer provides design consultation, IT procurement and a dedicated LiquidSpace concierge to help manage a customer’s move and the facility manager’s needs, where we can alter existing space into flexible space.

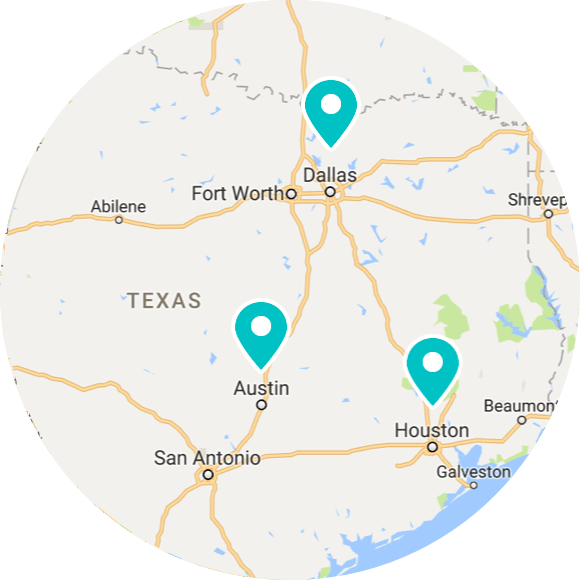

Austin is the city to benefit from altSpace as the tech and communication industries boom. To get insights into how a Fortune 500 company put their team culture in Dallas first read their customer success story. Building operators are adding flexibility to their asset portfolio to meet the evolving needs for flexibility from their customers. Olymbec has added altSpace to their portfolio in the Dallas Central Business District. Learn how you can leverage the altSpace program as a building owner.

In terms of size Austin has been lagging behind some of the larger markets for flexible office space. Coastal cities such as New York, and San Francisco have exploded with supply. In the Texas market Austin is right up there with Houston and Dallas in terms of the flexible office space. As a building operator learn how you can leverage the altSpace program in the Texas market.

Austin, also known as “Silicon Hills”, benefits from the booming established technology companies such as Dell, IBM, AMD, Apple who are growing their presence here. As the capital of Texas the state and local governments employ a large percentage of the population. The education sector consisting of many players from the Austin Independent School District to the Texas State University of Austin provides ample employment opportunities plus an educated labor force. Real Estate, medical and pharmaceutical are also booming in Austin making it an attractive, growing market that saw little detrimental effect from the financial crisis.

Austin ranked as the top U.S. Markets to Watch for growth and development based on the PWC Emerging Trends in Real Estate 2017 report. Austin surpassed Dallas (2), San Antonio (31) and Houston (40) in the ranking and has been in the top 10 for the last decade. Austin’s high investment rates 3.76 and high development rates 3.61 make this market HOT and here to stay.

32,700 net new jobs were added in the last 12 months. This is a 3.3% increase over the last 12 months. Transportation, education and healthcare were the fastest growing sectors in Austin. Unemployment is at 3.6% one of the lowest in the country and only slightly higher than 3.2% a year ago. The United States unemployment rate is at 4.5%, so Austin unemployment is significantly lower than the national average. The unemployment rate in Austin has been steadily falling since 2010 when it was at 7%. In addition to Austin’s affordable living, the average weekly wage rate continues to rise, reaching $1,158 and surpassing the U.S. average of 1,067.

Austin has added 1.2 million square feet of commercial real-estate, with 77% pre-leased upon completion according to the JLL Austin Q2 2017 Office Insights. Flexible office space interest in Austin is picking up. It is in the top 20 markets searched for on LiquidSpace, lagging behind Houston (5th) and Dallas (9th). Just last month there were 1196. With a 2.5X growth in flexible office space in the last year people have over 578 workspaces to choose from immediately available. A significant rise in millennials within the workforce will further impact the need for flexible office space. Yearly a new educated workforce graduates from the top universities in Austin and chooses Austin for it’s quality of life and diversity of industry. In fact 42.6% of the Austin workforce has a bachelor's degree or higher compared to the U.S. average of 30.6%.